NEWS RELEASE

For Immediate Release

May 29, 2020

Contact: Steve Radley

877.521.8600

[email protected]

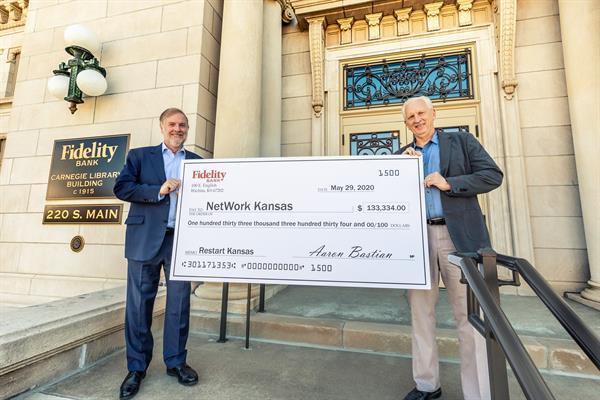

Clark Bastian, left, Fidelity Bank, Chairman of the Board, stands with Steve Radley, President/CEO, NetWork Kansas, to announce the Restart Kansas County Loan Fund. Photo credit: Fidelity Bank

NetWork Kansas Establishes Restart Kansas County Loan Fund

Low-Interest Loans up to $20,000 Available to Local Businesses

Wichita, Kansas, — Today NetWork Kansas launched Restart Kansas, an initiative led by local leadership teams and Network Kansas professionals to assist Kansas communities in creating a new resource for small businesses. While these funds will support the immediate needs of local businesses due to the COVID-19 crisis, they will also provide critical infrastructure to better meet the long-term needs of counties with additional loan programs to address future emergency situations.

Restart Kansas will provide low-interest loans up to $20,000 to business owners located in participating counties seeking emergency assistance to maintain or restart their businesses due to a disaster. These loans will have terms of two percent interest for 48 months with four months of deferred payments.

Small businesses have recently encountered situations theyve never dealt with before, and the need for local cities and counties to create new resources to assist them has never been greater, said Steve Radley, NetWork Kansas President and CEO. Times like these can often plant the seeds of opportunity for a better future, which is what prompted NetWork Kansas to develop this new loan fund while developing an infrastructure for future assistance.

More than $1.4 million in initial funding has been secured by utilizing the existing Entrepreneurship Tax Credit. Donors receive a 75% state income tax credit for their donation. A tax credit is a dollar-for-dollar credit against state income tax liability. The maximum allowable credit per year is $100,000.

Because a key component of Restart Kansas is to keep the dollars local, 60% of all donations utilizing the Entrepreneurship Tax Credit will be dedicated to the participating county. Additional funds may also be raised through charitable donations. Thanks to recent legislation, banks and savings and loans can now contribute and receive the tax credit.

This isnt just a program to support businesses, said Aaron Bastian, President and CEO of Fidelity Bank, headquartered in Wichita. Restart Kansas is lending confidence to business owners, employees, customers and their families all across Kansas. There is much healing to be done in every community on all fronts. We hope others will join us in helping to ease the burden for these organizations. Their resurgence will carry us all bravely onward.

To support as many businesses as possible throughout the state, it is important for local counties, communities, banks and other donors to come together to fully utilize the Entrepreneurship Tax Credit. Banks, corporations, and other donors interested in participating in this tax credit program can call 877.526.8600 and ask for Steve Radley or Erik Pedersen to make a commitment or to learn more.

Restart Kansas loan applicants must reside in one of the participating counties, complete a Restart Kansas application, receive approval by the local leadership team, complete all necessary paperwork and provide supporting documentation. NetWork Kansas currently works with more than 40 administrative support organizations and 66 Entrepreneurship (E-) Communities throughout the state. For more information about Restart Kansas, call 877.521.8600 or email [email protected].

About NetWork Kansas:

NetWork Kansas was established as a component of the Kansas Economic Growth Act of 2004 to further entrepreneurship and small business growth as a priority for economic and community development in the State of Kansas. Backed by more than 500 partners statewide, the NetWork Kansas service promotes an entrepreneurial environment by connecting entrepreneurs and small business owners with the expertise, education and economic resources they need in order to succeed.

NetWork Kansas facilitates the development of an entrepreneurial ecosystem within participating communities through the E-Community Partnership. Contributing factors to successful development include availability of financial capital, support by local leadership and development of educational resources. All of these factors combine to increase entrepreneurial activity in participating towns, leading to increased startup activity, business expansion, job creation and more.

###