eCommunity Partnership

Empowering Local Ecosystems Across Kansas

The eCommunity Partnership, an initiative of Network Kansas, is dedicated to fostering vibrant entrepreneurial ecosystems throughout the state. By working hand-in-hand with local communities, the Partnership provides essential tools, expertise, education and financial resources to support community-driven entrepreneurship and economic growth.

Components of an eCommunity

A Network Kansas eCommunity is committed to making entrepreneurship a central part of its economic development strategy. Our goal is to ensure that all 75 eCommunities include the following key components: Local Leadership Team, Financial Review Board, Local Revolving Loan Fund, eProgramming, and Technical Assistance.

Leadership Team

Financial Review Board

Revolving Loan Fund

eProgramming

Technical Assistance

The eCommunity Partner Network

Regional Community Advisors

Christy Preston

Send Email

Robert Wilson

Send Email

Lea Ann Seiler

Send Email

Becca Sweaney

Send Email

Janet Miller

Send Email

Dyelan Reed

Send Email

Christina Long

Send Email

Michael Odupitan

Send Email

Nicole Rials

Send Email

Community Entrepreneurship Advisors

Need Help?

We tailor solutions to fit each community's needs.

eCommunity Impact

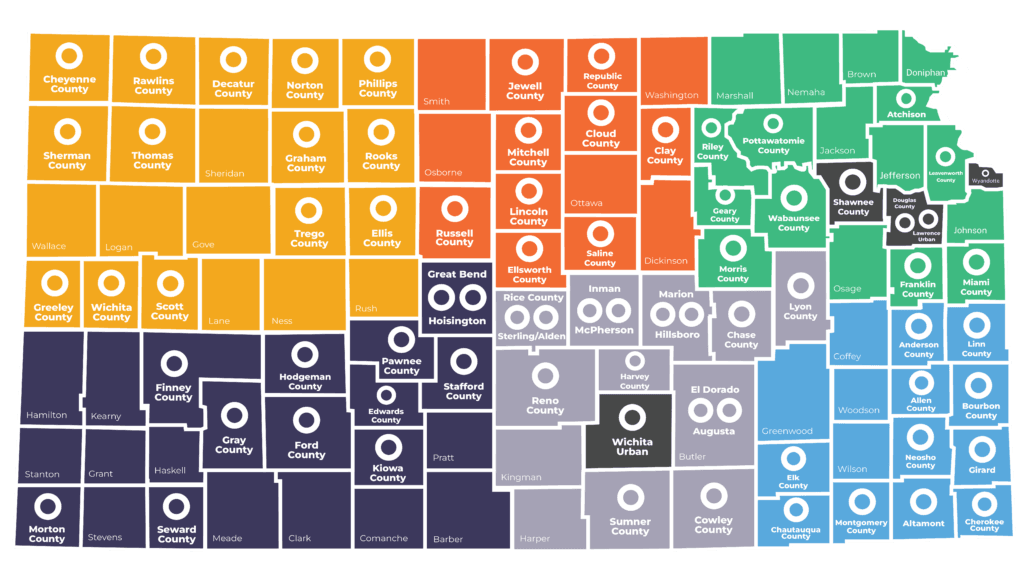

With over 75 community partnerships spanning the state, the eCommunity Partnership serves as a catalyst for sustainable economic development. Success is measured through entrepreneurship growth, strengthened ecosystems, and the tangible results achieved by local businesses and leaders.

The eCommunity Loan Fund

eCommunity loans cover up to 60% of your total loan needs. The remaining 40% must be secured from other sources, such as a bank, credit union, or public funding options like city/county revolving loan funds, USDA programs, or foundations. In addition, eCommunity partners have access to a range of other funding opportunities through Network Kansas, including programs like GrowKS, the Kansas Community Investment Fund (KCIF), and the Kansas Healthy Food Initiative (KHFI).

Loan Amount

Loan Term

Interest Rate

Loan Activity over Time

| Year | Total eCommunities | Total Loans |

|---|---|---|

| 2009 | 12 | 20 |

| 2011 | 25 | 76 |

| 2013 | 39 | 181 |

| 2015 | 48 | 275 |

| 2017 | 61 | 431 |

| 2019 | 66 | 615 |

| 2021 | 66 | 787 |

| 2023 | 73 | 960 |

Why it matters.

Tested, effective solutions.

The long-term benefits of being an eCommunity are profound: from fostering a culture of innovation to ensuring that future generations inherit a thriving, adaptable economy, the eCommunity Partnership sets the stage for continuous, sustainable progress across Kansas.

Join the Partnership

Network Kansas is inviting communities to apply for the eCommunity Partnership, a prestigious program that champions entrepreneurship through access to capital, coaching, and statewide resources.

What you need to know

- Chosen communities will be required to have a monthly meeting with the assigned Community Entrepreneurship Professional and a proposed team of your choice.

- We’re looking for community leaders that demonstrate a clear, ongoing focus in supporting entrepreneurship.

- Applicants must be considered a county, community, region, or district to apply.

- There will be no set number of application approvals.

- Applications will open January 2026 and close March of 2026. Final selections will be announced July of 2026.

Frequently Asked Questions (FAQ)

What is a Community Entrepreneurship Advisor?

Community Entrepreneurship Advisors are local contacts in distinct parts of the state. They know the area and can help guide you with a unique, local perspective.

How do I join the eCommunity Partnership?

While we are not adding new partners in 2025, please consider applying in 2026!

How do I access funds?

Visit with our Impact Investment Center (IIC) team to discover your local partner.